October rounded off in grand style for the crypto community, with severe networks recording gains. This week, the crypto market is still intoxicated with the elixirs of last week’s momentum, gyrating upwards in search of new hills to annex. More than anything else, the week featured strong bullish momentum for most, a suffocating bearish grip for a few.

Terra Classic loses $130 million in 24 hours

Months ago, Terra Classic (LUNC) experienced a miracle, jumping more than 200 places on the global coin ranking. Unfortunately, things have since changed. Terra Classic is fast offloading past gains in concert with the general bearish market. On the 1st of November, market capitalization for the LUNC, according to CoinMarketCap data, collapsed from $1.60 to $1.47 billion, revealing a wipe-off of over $130 million in less than 24 hours.

According to CoinMarketCap data, the decline represented an 8.8% drop in value. Crypto pundits argue that the value decline experienced by Terra Classic ultimately reflects the bearish sentiment of the crypto market amidst its internal issues. Currently, Terra Classic is trading at $0.0002231, a 7.87% decline in the past seven days.

Provider Hetzner blocked access to servers with Solana nodes

Over 1000 Solana validators went offline this week as Hetznerblocked Solana network activities on its server. The incident shuts down one-fifth of the Solana stakes that secures the Solana network, rendering 22% of the entire Solana stake delinquent (an occurrence where the validator handling a stake goes offline).

Hetzner, the server provider for these validators, had initially contemplated shutting down all crypto node operators on its platform because crypto activities are prohibited according to Hetzner's terms of service. According to a report by The Block, 16% of all Ethereum's hosting nodes were the focus of Hetzner. This percentage has since fallen to 12%. Unfortunately, the company seems to have turned its attention to Solana validators, shutting off their access to its servers, thus rendering their stake in the Solana network delinquent.

Despite the situation, the Solana network is hitch-free, although 22% of its network security vote remains offline. Solana Validators and Delegators impacted by Hetzner's actions must find reliable server alternatives to get their stake back online and resume the receipt of stake rewards. Yakovenko Anatoly, the co-founder of Solana Labs, encouraged validators and delegators affected by Hetzner's action to move their stake elsewhere.

Deribit exchange hot wallet hacked for $28 million

Over 1000 Solana validators went offline this week as Hetznerblocked Solana network activities on its server. The incident shuts down one-fifth of the Solana stakes that secures the Solana network, rendering 22% of the entire Solana stake delinquent (an occurrence where the validator handling a stake goes offline).

Hetzner, the server provider for these validators, had initially contemplated shutting down all crypto node operators on its platform because crypto activities are prohibited according to Hetzner's terms of service. According to a report by The Block, 16% of all Ethereum's hosting nodes were the focus of Hetzner. This percentage has since fallen to 12%. Unfortunately, the company seems to have turned its attention to Solana validators, shutting off their access to its servers, thus rendering their stake in the Solana network delinquent.

Despite the situation, the Solana network is hitch-free, although 22% of its network security vote remains offline. Solana Validators and Delegators impacted by Hetzner's actions must find reliable server alternatives to get their stake back online and resume the receipt of stake rewards. Yakovenko Anatoly, the co-founder of Solana Labs, encouraged validators and delegators affected by Hetzner's action to move their stake elsewhere.

Binance CEO wants to buy banks and join Twitter's board of directors

Binance founder and CEO Changpeng Zhao sees buying banks as a way to bridge the gap between the worlds of traditional finance and cryptocurrencies. Zhao did not name any specific targets, and also said he is open to either minority investment or a full acquisition. Zhao also noted that investing in banks is a smart strategy for Binance.

Also the other day, the director of Binance announced his readiness to join the board of directors of Twitter if he were invited by the new owner of the social networking platform, Elon Musk. Binance previously provided financial support for the acquisition of Twitter.

October 31 marks the 14th anniversary of White Paper Bitcoin

On October 31, 2008, one person or group of people under the pseudonym Satoshi Nakamoto published the Bitcoin white paper. The white paper introduced the working principle of a peer-to-peer payment system that revolutionized the world of financial technology.

The Bitcoin network was launched in January 2009. After 2 years, Satoshi Nakamoto stopped any publications, the crypto community still does not know who the author of the document is. In 14 years, Bitcoin has come a long way and has become an important and significant financial instrument. Cryptocurrency is bought by both serious investors and public companies, as well as ordinary members of the crypto community. Many see Bitcoin as a way to protect their funds during a period of major economic change.

Coinbase backs Ripple in the fight against the SEC

Coinbase has applied to the court for permission to file an amicus brief in support of Ripple. Amicus brief is a legal document containing advice or information from an organization that is not a party to a conflict. Coinbase said it disagreed with the SEC that they did not first provide a notice of the illegality of the XRP sale before filing a lawsuit.

A programmer spent 69 nights in "Bitcoin Cash City" using only BCH

In 2019, the coastal city of Townsville, Australia hosted the city's Bitcoin Cash Conference. Since then, the city has become an important player in the Australian crypto community, with several merchants accepting Bitcoin Cash as a payment method. Recently, programmer Jonathan Silverblood flew to Townsville to fulfill his promise to return to the city after a great conference in 2019, which, to his amazement, showed the city's incredible support for a forked version of Bitcoin.

Jonathan Silverblood, a BCH programmer who has been working on generic protocols for the past three years while on a BCH salary, flew to Townsville. He set himself the goal of paying for all purchases and services with BCH coins while on vacation with his family. He noted that he managed to pay most of it with cryptocurrency, but sometimes his family wanted to go somewhere else, and not eat at certain stores that accept BCH.

During the trip, Jonathan lamented problems with payment terminals running out of power, lack of Wi-Fi access, and merchants not always being able to offer cryptocurrency payment options. Although cryptocurrencies already exist and work, their adoption by merchants is slow, he said. Summing up, Jonathan said that he would definitely repeat this adventure in other cities.

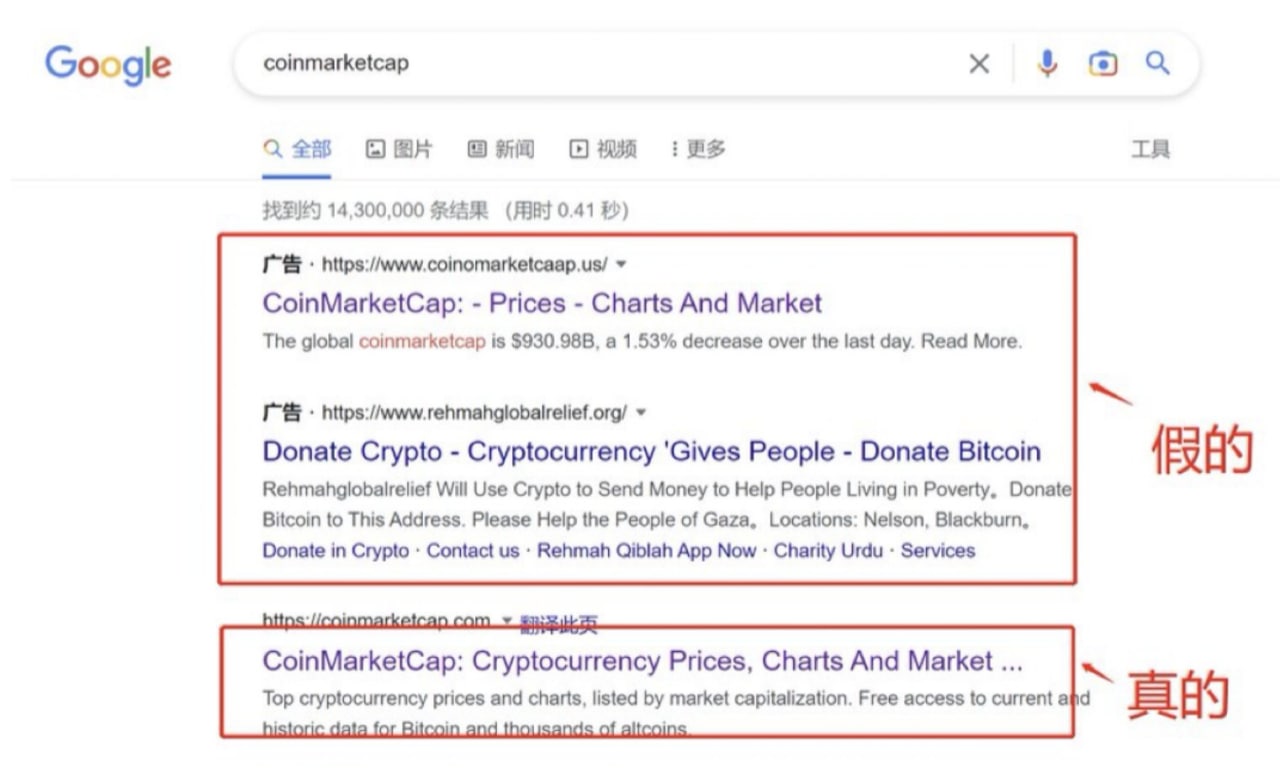

Google shows phishing sites when users search CoinMarketCap

When trying to find CoinMarketCap, Google shows users phishing sites. These links are marked as advertisements. For safety reasons, it is recommended that you never cross them.

FixedFloat users also face this problem. As a result of the search, in the first lines you can see sites similar to fixedfloat.com. We remind you that we use only one domain — fixedfloat.com, all the rest are scammers. Be careful and check the address bar before sending coins for exchange