Silvergate liquidates its bank

Silvergate Bank has been focused on serving cryptocurrency companies and their clients. The bank provided its services to companies such as cryptocurrency exchanges, institutional investors, OTC traders and other businesses related to cryptocurrencies. Due to its specialized focus on cryptocurrencies, Silvergate Bank has been one of the most popular banks among crypto companies in the US and beyond. The bank was the 16th largest US bank. The crypto community is currently facing the consequences of this event. So, USDC lost its peg to the dollar. The likely reason is that Circle held $9.88 billion in Silicon Valley Bank.

BTC falls below $20,000, there is a lot of FUD in the market

Bitcoin also suffered from the collapse of Silvergate Bank. For the first time in 2 months, the exchange rate fell below $20,000. Also, the New York Attorney General’s lawsuit against the KuCoin crypto exchange had an impact on the fall in the rate, which may later change the opinion of regulators about cryptocurrencies. And the recent fall in US stock prices in a negative direction has changed the mood of investors.

The hacker who hacked the DeFi protocol based on Arbitrum returned the stolen assets

On March 7, an unknown person, using an error in the configuration of the price oracle, borrowed $1.59 million secured by a token, the price of which was around $71. He later contacted the developers via a message in a transaction. The developers confirmed the incident and as a result of the agreement, the hacker returned the funds to them, keeping the agreed reward of 62.16 ETH. Over the previous month, 7 cases of hacking DeFi protocols were recorded, the total damage of which is approximately $21.4 million.

Aave will recover lost tokens

The proposal to recover tokens sent to erroneous smart contracts received 100% support on the Aave DeFi platform. According to the developers, the presence of smart contracts in the ecosystem makes it possible to restore tokens. Of the total recoverable tokens of approximately $2.18 million, there are 29,188 AAVE worth $2.16 million. Recovery will only be impossible if the amount of funds is less than $500 and if the transaction came from a centralized exchange. After recovering the tokens, the funds will be sent to the distributor's smart contract, which the owners can contact for a refund.

Tornado Cash developer introduced a fork of the protocol

Tornado Cash developer Amin Soleimani forked the protocol and offered users a new project, Privacu Pools, using zero-knowledge proof. The protocol allows users to use privacy settings and prohibit the mixing of coins with criminal funds. This allows users to increase their anonymity and also isolate themselves from scammers and hackers. But you should be careful when using it, since the project has not yet passed the audit of auditors.

USDC lost its peg to $1

The USDC has fallen on hard times. Information is being actively discussed in the media that up to 20% of reserves are kept in bankrupt banks. The stablecoin has lost its peg to the dollar and is currently hovering around $0.95 Crypto exchange Coinbase has temporarily suspended USDC trading. There is an increase in active carrying, USDC holders are actively selling the token.

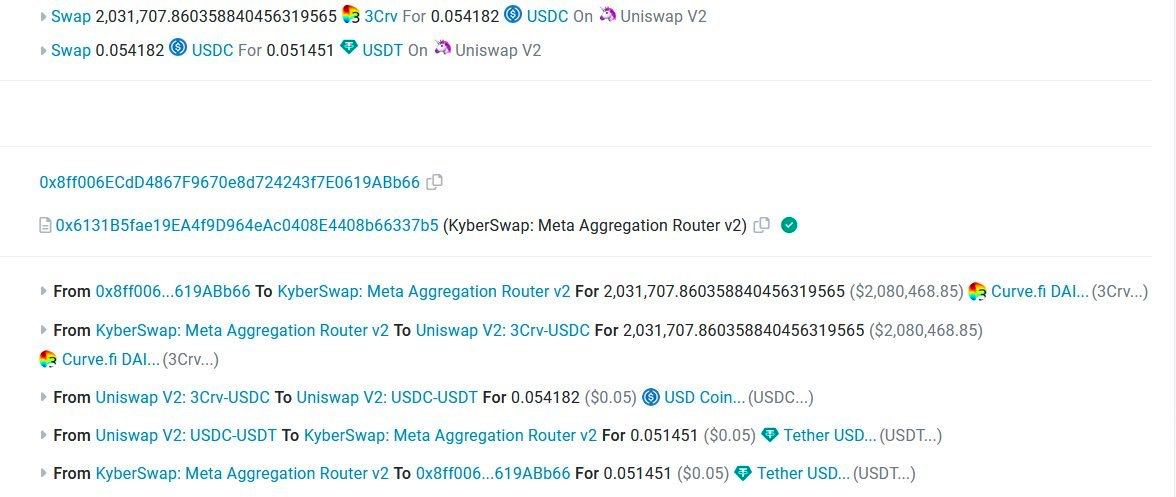

So, one user made a terrible exchange in Kyberswap DEX, who sent the trade to the Uniswap v2 pool, and received only 5 cents in USDT for 2,000,000 USDC, since the liquidity in the pool was only a few dollars.

New York Attorney's Office files lawsuit against KuCoin

The New York State Attorney's Office has filed a lawsuit against the KuCoin crypto exchange, in which it alleges that the platform violated securities laws. In the lawsuit, prosecutor Letitia James refers to Ethereum as a security, the first such determination in court. In court documents, ETH, along with LUNA and UST, is called a speculative asset, the profit of which depends on the efforts of third-party developers. As a result of these allegations, the exchange, according to James, had to register before selling these cryptocurrencies. James asks the court to ban KuCoin from providing its services in the state of New York.

The opinion that all cryptocurrencies except BTC are securities does not sound for the first time. The SEC has already said so. If cryptocurrencies are indeed recognized as securities, this threatens to seriously change the market.

El Salvador continues to delight BTC fans

The State of El Salvador, along with its President Nayib Bukele, is one of the most ardent supporters of BTC. The country is actively investing in the currency and spreading its use. Not so long ago, the president announced that after the legalization of BTC, tourism in the country increased by 95%, and more and more areas in which the currency is used to pay. You can now pay the immigration fee with BTC when you arrive at El Salvador airport. The country is not going to stop there and plans to further integrate BTC into its economy.